Photo by Isaac Smith / Unsplash

You read it right—sales funnel metrics that marketers should be keeping an eye on. Shocking, I know!

But here's the thing: the lack of communication between marketing and sales is one of the 7 reasons why life sciences companies are falling behind in digital marketing. So, instead of treating this as forbidden territory, let’s talk about why it actually makes perfect sense for marketers to get themselves mixed up in sales metrics.

Marketing’s role is to acquire new customers, nurture existing ones, and keep the sales pipeline filled with quality leads. But how can marketers do their job effectively without insight into the sales funnel?

Why should they even bother bringing in leads if they don’t know how those leads are being converted by the sales team?

It's time to break down the silos between marketing and sales and start sharing metrics openly. By giving your marketing team the right data, you're setting them—and your company—up for success.

So let's take a look at the key metrics to keep an eye on:

1. Average deal size

The average deal size measures the typical revenue generated from a deal over a specific time period. It’s a crucial metric because it indicates the scale of each closed deal, directly impacting how your company operates. A small average deal size means you'll need a high volume of clients to sustain the business, whereas a company with a larger average deal size might thrive with just a few clients each month.

How to calculate your average deal size?

For example, if your company closed three deals this quarter worth €1,000, €5,000, and €6,000, your average deal size for the quarter would be (1,000+5,000+6,000)/3 = €4,000

💡

Want to calculate your metrics more quickly?

Check out

, a free online calculator for average order value, return on ad spend, cost per lead and more.

Why should marketers monitor their average deal size?

Without knowing your average deal size, your marketing strategy is like flying blind. How can you assess the value of your marketing campaigns if you don’t know how much revenue a typical client brings?

I’ve managed marketing campaigns with budgets of several thousand euros that resulted in just one client. On the surface, that might sound like a poor outcome, but when you consider that the average deal size for those companies often exceeds €50,000, the marketing investment quickly becomes justifiable.

What to keep in mind about the average deal size for science-driven companies?

In science-driven industries, the average deal size tends to be large, and that's normal because scientific tools and services are always expensive commodities. This means that most science marketers would be better off betting on the quality of their leads rather than the quantity. When fewer high-quality leads can make a significant impact, broad marketing strategies aimed at wide audiences might not be the best approach.

If your average deal size is large, consider investing your marketing budget in highly targeted campaigns. And don’t worry if your webinars don’t attract thousands of attendees—it might be more beneficial to have an intimate conversation with a few high-potential leads.

2. Average sales cycle

The average sales cycle measures the typical time it takes for a prospect to move through your sales pipeline and convert into a client. It begins when a lead first becomes aware of your products or services and ends when they make a purchase or commit to buying.

The length of the sales cycle can be very short (a few hours or a few days), but can also span months or even years, especially in science-oriented industries.

How to calculate your average sales cycle?

For example, if your company closed three deals this quarter, each taking 30, 70, and 120 days respectively, your average sales cycle for this quarter is (30+70+120)/3 = 73 days.

Why should marketers monitor their average sales cycle?

The average sales cycle is a good qualitative metric to contrast with the quantitative nature of the average deal size. A deal might bring in significant revenue, but if it takes three years to close, you’ll need to ensure a consistent influx of leads to sustain your business through these long cycles without income.

That’s why it’s important to know this metric, even if it seems more relevant to the sales team. A shorter sales cycle, for instance, could indicate a highly effective sales representative. Knowing this can help you identify best practices from the sales team and ensure they are implemented throughout the sales funnel.

What to keep in mind about the average sales cycle for science-driven companies?

Selling a scientific innovation often requires a lengthy process. Labs need to budget for this new piece of high tech, get the proper authorization, and maybe even figure out how to integrate it into their existing space —all after you’ve convinced them of the value of your product for their research.

So don't be surprised if your sales cycle takes years, as that's pretty much the norm when it comes to high-tech, scientific solutions.

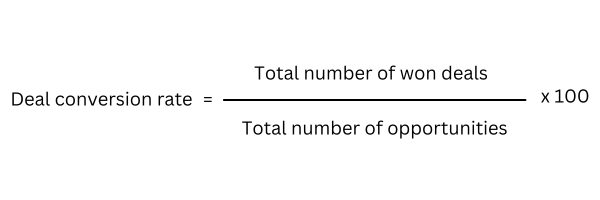

3. Deal conversion rate

The deal conversion rate is the percentage of opportunities that turn into new customers. This metric is one of the best indicators of the combined effectiveness of your marketing and sales efforts, as it captures the entire journey of your prospects through the sales funnel.

How to calculate your deal conversion rate?

For example, if your company closed three deals out of 12 opportunities generated this quarter, your deal conversion rate would be (3/12)x100 = 25%.

Why should science marketers monitor their deal conversion rate?

As I already highlighted in my previous article about lead generation, the deal conversion rate is the key metric to look at when analyzing your sales funnel. Knowing this metric allows you to see the bigger picture—how effectively your leads are moving through the funnel and converting into clients.

Once you know your deal conversion rate, you can easily calculate the number of leads needed to hit your sales targets (more about that in the last part of this article). This metric also helps pinpoint issues within your sales funnel by breaking it down into different stages (e.g., from lead to MQL, MQL to SQL, etc.), allowing you to identify where potential clients are dropping off.

What to keep in mind about the deal conversion rate for science-driven companies?

Life sciences companies often have a higher deal conversion rate, typically ranging from 10% to 20%, due to their focus on specialized, well-targeted leads from the outset.

So, if your deal conversion rate is below 10%, and your company isn’t selling a widely used product or service, it might be time to reassess the effectiveness of your funnel. This could mean refining your targeting strategies, improving lead nurturing processes, or addressing other gaps in your sales and marketing alignment.

4. Cost per lead

The cost per lead is the average amount of money your company spends to acquire a new lead. You can calculate this metric across all marketing channels combined or break it down by individual strategies, such as paid ads, content marketing, or social media (though some channels may be difficult to attribute).

This metric also plays a big role in your overall customer acquisition cost, which we’ll cover next.

How to calculate your cost per lead?

For example, if your company spent €5,000 to acquire 70 new leads, your cost per lead would be 5,000/70 = €71 per lead.

Why should marketers monitor their cost per lead?

The lack of data-driven marketing is a common problem among science marketers. In my opinion, this is due to the top-down nature of our industry, mostly driven by traditional sales approaches that favor face-to-face interactions.

As a result, science marketers are not incentivized to get a clear picture of the cost of acquiring new leads and get used to spending their budget blindly because no one in the organization really cares how many leads are generated as long as they feel like some leads are coming in.

However, monitoring your cost per lead is crucial for gaining a clear picture of the effectiveness and efficiency of your marketing efforts, especially in a data-driven world where every euro spent should be justifiable.

What to keep in mind about the cost per lead for science-driven companies?

The cost per lead is a key metric for understanding the effectiveness of your marketing at the top of the funnel. In general, the cheaper you can get leads, the better it is for the bottom line, but in our science-oriented field, I wouldn't always recommend looking for the lowest cost per lead.

Since selling to scientists usually involves fewer but highly valuable leads, a higher cost per lead can indicate a well-targeted strategy that focuses on specialized professionals. The more targeted your audience, the higher your cost per lead might be, simply due to the smaller pool of potential leads.

Although it's important to experiment with reducing your cost per lead, always balance this with other metrics like conversion rates. Expensive leads can still be very valuable, especially if they convert at a higher rate and contribute significantly to your revenues.

5. Return on ad spend

The return on ad spend (ROAS) tells you exactly how much money you have generated from a specific ad or marketing campaign. While the cost per lead focuses solely on expenses, the ROAS gives you the full picture by showing how much revenue each euro invested in a campaign brings in. Although tracking ROAS can be more complex due to the need for clear attribution paths from campaign to revenue, it works really well for traditional ad campaigns with proper tracking enabled and can show you which campaigns are worth investing in.

How to calculate your ROAS?

For example, if you invest €10,000 in an advertising campaign and generate €40,000 in revenues, your ROAS would be 40,000/10,000 = 4. This means that for every €1 spent, the campaign generated €4 in revenue.

Why should marketers monitor their ROAS?

Spending blindly on ad campaigns without tracking the return on investment isn’t a great idea. With online marketing, it's fairly easy to track the traffic generated by ads and, with some effort, tie it to the revenue generated.

Sure, if your customer journey involves a face-to-face meeting with a sales rep, you may need to make sure the origin of each deal is accurately recorded in your CRM, but it's not that hard to do, and the data is a gold mine (literally, this data is really valuable for scaling a business).

Once you have reliable ROAS tracking in place, you can continually compare and optimize your campaigns, focusing your investment on those that consistently deliver strong returns.

What to keep in mind about the ROAS for science-driven companies?

Science-driven companies often have longer sales cycles. This means that traditional ROAS metrics, which are usually focused on short-term gains, might not accurately capture the true value of your advertising efforts. So keep in ming to always align your ROAS calculations with the length of your sales cycle to get a more realistic picture of performance.

Another factor to consider is customer lifetime value (a metric I discuss in more detail later in this article). While your upfront ROAS may seem low, factoring in the long-term revenue from each customer can also improve your perspective. Keep in mind that all of the metrics in this article paint a bigger picture of your business and should be considered together for a more granular analysis of your marketing efforts.

6. Customer acquisition cost

The customer acquisition cost (CAC) is the total amount a company spends to acquire a new customer. This metric is very helpful to understand how much money is really needed to drive growth. Unlike cost per lead, which is typically linked to specific campaigns, CAC offers a broader perspective by including overall costs across marketing and sales.

How to calculate your customer acquisition cost?

For example, if a company spends €1 million on marketing and sales in a quarter (including salaries) and acquires 10 new customers, the CAC would be 1,000,000/10 = €100,000.

Why should marketers monitor their customer acquisition cost?

Marketers who only look at their cost per lead are missing a key piece of the sales puzzle. Without knowing your CAC, you can’t accurately assess whether your business is profitable or simply overspending on customer acquisition.

Your CAC is also essential for setting your marketing budget. By comparing it with customer lifetime value, which we’ll discuss next, you can determine how profitable acquiring a new customer really is and decide if it’s worth investing more in marketing to drive growth.

What to keep in mind about the customer acquisition cost for science-driven companies?

As you might expect, CAC tends to be high in science-driven industries. The unique nature of this field means that customers often require significant time, education, and trust before making purchasing decisions. These factors drive up costs, especially when employing scientists and other specialized staff within your marketing and sales teams.

But remember, science-driven companies tend to play with high average deal sizes anyway, so high acquisition costs aren't necessarily a bad thing. The key is to ensure that your CAC is in line with your business model and financial goals. In this context, a high CAC can be perfectly acceptable as long as it supports sustainable growth and profitability.

7. Customer lifetime value

The customer lifetime value (CLV) represents the total revenue a customer is expected to generate throughout their entire relationship with your company. While the average deal size gives insight into short-term gains, the CLV is a long-term perspective on a customer's overall contribution to your business

How to calculate the customer lifetime value?

The customer lifetime value isn’t as straightforward to calculate as other metrics because it can vary significantly depending on your business model and the timeframe you’re considering.

For science-driven B2B companies, where purchase decisions often take time, a simplified formula is:

For example, if a company has an average deal size of €10,000, with customers making purchases twice a year over a 5-year period, the CLV would be 10,000x2x5 = €100,000.

Note that the CLV can be calculated for your entire customer base using average or focused on individual customers, depending on the insights you need.

Why should marketer monitor their customer lifetime value?

This metric is great to compare to your customer acquisition cost. If you know how much it costs to acquire a customer and how much revenue they will generate over their entire customer cycle, it's easy to understand if you're making or losing money (just look at the difference between the two numbers).

The customer lifetime value also forces you to track and analyze sub-metrics that are very important to any business, such as the average number of purchases and the average lifespan of your customers. Improving either of these (or both) will increase your customer lifetime value, and thus your company's success.

What to keep in mind about the customer lifetime value for science-driven companies?

One of the benefits of selling expensive innovations is that it tends to lock in customers for a long time. This extended lifespan can drive up the CLV, justifying a higher spend on customer acquisition. However, it also highlights the challenge of converting customers who are already using competing solutions.

This is also an excellent metric to consider when designing a business model. For example, selling equipment that requires consumables or add-ons will lead to recurring purchases, thereby increasing the CLV. By focusing on strategies that extend customer relationships and boost recurring revenue, you can maximize the long-term profitability of your business.

8. Customer churn rate

The customer churn rate measures the percentage of your existing customer base that is lost during a specific period. It provides insights into customer retention and satisfaction, reflecting how well you maintain your customer relationships over time.

How to calculate your customer churn rate?

For example, if a company starts the month with 200 customers and loses 2 of them, the churn rate for that month is (2/200)x100 = 1%. This means 1% of the existing customer base was lost during the month.

Why should marketers monitor their customer churn rate?

All companies experience churn, and it's a healthy practice to track this metric as it can indicate problems with how your customers perceive the value of your product, or, on the contrary, show that your company is able to retain customers more easily than in the past.

A rising churn rate can signal problems such as declining product satisfaction, poor customer service, or increased competition. On the other hand, a decreasing churn rate after a product update or new service launch can indicate positive customer responses. It’s important to investigate these changes to understand what’s working and to replicate or enhance successful strategies.

What to keep in mind about the customer churn rate for science-driven companies?

In science-driven industries, where switching providers can be complex and costly, the churn rate is typically expected to be low.

If you experience a high churn rate, it’s crucial to act quickly. High churn can jeopardize your business’s stability and growth, making it essential to identify and address the underlying issues promptly. By focusing on customer feedback and improving your offering, you can work to reduce churn and maintain a healthy, loyal customer base.

Using sales funnel metrics to retro-engineer your sales target

A savvy marketing team doesn't just blindly generate leads; it's an integral part of the company's growth engine, understanding the big picture and helping to achieve revenue goals, not just visibility.

The metrics detailed in this article have one thing in common: they are necessary to align your sales funnel with your revenue targets. While finance teams may set revenue goals, it’s up to marketers to assess whether these targets are realistic or pure fantasy.

With these metrics, you can easily start with a revenue goal and retro-engineer each step of the customer journey based on existing conversion rates.

For example, by combining your average deal size, average sales cycle, and deal conversion rate, you can accurately predict what will come out of your sales funnel.

With other metrics like cost per lead, return on ad spend, and customer acquisition cost, it's easy to allocate your marketing budget across the different channels at your disposal.

These metrics are the tools you need to plan, analyze and iterate on the campaigns that will drive your business forward, so take some time to make sure they are all present on your marketing dashboard.